Encouraging Entrepreneurs: Leveraging Tough Money Financings for Company Development

In the realm of entrepreneurship, the quest of development and expansion commonly depends upon protecting ample financial resources. Tough cash car loans have actually emerged as a practical choice for business owners aiming to leverage outside financing to propel their services onward. While the principle of hard money loans might seem simple, the details of this financial device hold the potential to empower entrepreneurs in manner ins which standard lending may not. By exploring the nuances of difficult money finances and their effects for business expansion, entrepreneurs can gain valuable insights into how this alternate financing technique might be the driver for their next phase of growth.

Understanding Tough Money Car Loans

Hard cash finances are a type of financing generally safeguarded by the value of a property, giving a quicker and a lot more flexible alternative for debtors with particular financing requirements. hard money loans in ga. Unlike typical small business loan, tough cash fundings are typically used by exclusive capitalists or companies and are based upon the collateral worth of the building instead of the borrower's creditworthiness. This makes tough money loans suitable for individuals or services that may not get conventional financings because of credit scores concerns, income verification troubles, or the need for a quick funding procedure

The application procedure for hard money financings is usually much faster and less rigid than traditional fundings, making them an eye-catching option for customers aiming to secure funding promptly. While conventional finances might take weeks and even months to authorize, difficult cash financings can frequently be processed in a matter of days. Furthermore, difficult cash lending institutions are more prepared to deal with debtors on a case-by-case basis, permitting even more tailored and adaptable terms to fulfill the borrower's specific needs.

Benefits for Business Growth

Leveraging hard cash lendings can offer significant advantages for business owners looking for quick organization development via alternate financing services. One essential benefit is the rate at which tough cash finances can be protected compared to conventional small business loan. This fast accessibility to resources permits business owners to utilize on time-sensitive chances, such as purchasing inventory at an affordable rate or investing in new tools to boost production capacity.

Moreover, difficult cash fundings are asset-based, meaning that the financing approval is largely based on the value of the security instead of the debtor's credit report. This facet makes hard cash lendings a lot more accessible to entrepreneurs with less-than-perfect credit rating backgrounds, enabling them to get the necessary funding to expand their organizations.

:max_bytes(150000):strip_icc()/terms_h_hard_money_loan-FINAL-b9af7690939e45d5a80e25ee55c83d40.jpg)

Eligibility and Application Process

When considering tough money finances for business growth, recognizing the eligibility demands and application procedure is essential for business owners looking for alternative funding alternatives. Lenders offering difficult cash loans are mostly concerned with the residential or commercial property's potential to create returns and the borrower's capacity to repay the loan. The application process for difficult money loans is frequently quicker than traditional financial institution lendings, with decisions being made based on the home's worth and possible profitability of the company growth.

Leveraging Difficult Cash for Growth

Recognizing the tactical utilization of alternative financing mechanisms like hard money lendings can considerably reinforce company expansion efforts for entrepreneurs. Leveraging hard money for development entails taking advantage of these non-traditional resources of funding to fuel growth initiatives such as expanding line of product, getting in brand-new markets, or scaling procedures. By accessing difficult money financings, business owners can safeguard funding rapidly without the extensive documentation and authorization procedures usually related to standard loans. This dexterity enables companies to maximize time-sensitive possibilities and implement growth techniques promptly.

Moreover, hard money fundings supply flexibility in terms of collateral requirements, making them available to entrepreneurs who may not have substantial assets or a strong credit scores history. Additionally, the short-term nature of hard cash loans can be beneficial for entrepreneurs looking for to money particular expansion tasks without devoting to lasting financial debt responsibilities.

Risks and Considerations

Careful assessment of prospective dangers and factors to consider is vital when discovering the use of tough cash finances for organization growth. Among the main dangers connected with hard money loans is the high-interest prices they lug. Unlike typical financial institution fundings, difficult money lendings generally come with dramatically greater rate of interest rates, which can increase the total expense of borrowing and influence the productivity of the service. Furthermore, hard cash finances commonly require much shorter payment periods, raising the monetary pressure on the consumer to satisfy the repayment terms without delay.

Verdict

In final thought, hard cash fundings provide business owners a practical choice for company development. With their fast authorization process and adaptable terms, these financings supply an opportunity for development and advancement. However, entrepreneurs have to thoroughly take into consideration the dangers involved, such as greater rate of interest prices and potential security demands. By leveraging hard cash lendings successfully, entrepreneurs can equip their organizations to reach new elevations and achieve their growth objectives.

Jonathan Taylor Thomas Then & Now!

Jonathan Taylor Thomas Then & Now! Angus T. Jones Then & Now!

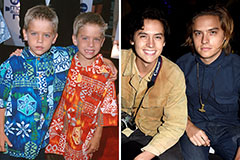

Angus T. Jones Then & Now! Dylan and Cole Sprouse Then & Now!

Dylan and Cole Sprouse Then & Now! Mason Gamble Then & Now!

Mason Gamble Then & Now! Jeri Ryan Then & Now!

Jeri Ryan Then & Now!